Understanding Final Paycheck Laws by State

What is a Final Paycheck?

A final paycheck is the last payment an employee receives from their employer after they have been terminated or have quit their job. This paycheck should include all wages and compensation owed to the employee, as well as any accrued vacation time or sick leave.

When Should You Expect to Receive Your Final Paycheck?

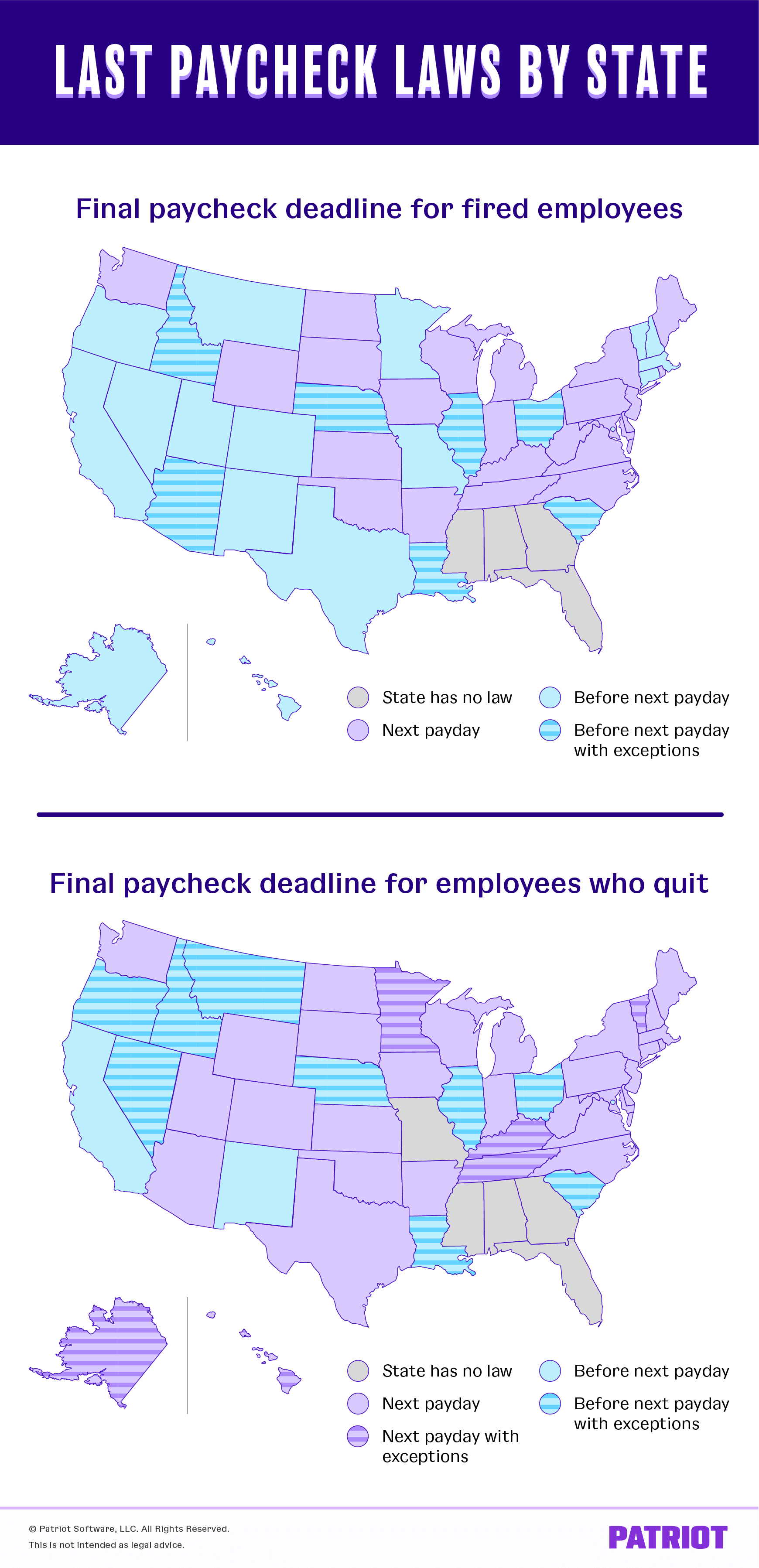

The timing of your final paycheck depends on the state in which you work. Some states require employers to pay employees their final paycheck immediately upon termination, while others allow a certain amount of time for the employer to issue the paycheck.

Here are some examples of state laws regarding final paychecks:

- California: Final paychecks must be issued immediately upon termination if the employee was fired or laid off. If the employee quit without giving notice, the employer has 72 hours to issue the final paycheck. If the employee gave at least 72 hours' notice, the final paycheck must be issued on the last day of work.

- New York: Final paychecks must be issued within five days of the end of the pay period in which the termination occurred. If the employee gave at least one pay period's notice, the final paycheck must be issued on the last day of work.

- Texas: Final paychecks must be issued within six days of the termination date.

What Should Be Included in Your Final Paycheck?

Your final paycheck should include all wages and compensation owed to you, including any accrued vacation time or sick leave. It should also include deductions for taxes, social security, and any other applicable withholdings.

Here are some examples of what should be included in your final paycheck:

- Wages for all hours worked, including overtime

- Compensation for any unused vacation time or sick leave

- Any bonuses or commissions owed

- Deductions for taxes, social security, and other withholdings

What Should You Do if You Don't Receive Your Final Paycheck on Time?

If you don't receive your final paycheck on time, you should first contact your employer to inquire about the delay. If your employer refuses to issue your final paycheck or is unresponsive, you may need to file a complaint with the labor department in your state.

FAQ

Q: What happens if my employer doesn't include my accrued vacation time in my final paycheck?

A: Your employer is required by law to include any accrued vacation time in your final paycheck. If they fail to do so, you should contact the labor department in your state to file a complaint.

Q: Can my employer withhold my final paycheck if I owe them money?

A: No, your employer cannot withhold your final paycheck to recover money you owe them. However, they may be able to take legal action against you to recover the debt.

Q: Can my employer issue my final paycheck via direct deposit?

A: Yes, your employer can issue your final paycheck via direct deposit as long as you have previously authorized direct deposit for your regular paychecks.

Q: What should I do if my employer issues my final paycheck for less than I am owed?

A: If you believe your final paycheck is incorrect, you should first contact your employer to inquire about the discrepancy. If your employer refuses to correct the mistake, you may need to file a complaint with the labor department in your state.

Pros and Cons of Final Paycheck Laws by State

Pros:

- Protects employees from receiving unfair compensation

- Provides a clear framework for employers to follow

- Ensures that employees receive all wages and compensation owed to them

Cons:

- Can be confusing and difficult for employers to navigate

- May result in legal disputes between employers and employees

- Can be time-consuming and costly for both parties

Conclusion

Understanding final paycheck laws by state is essential for both employers and employees. Employers must comply with these laws to avoid legal disputes and ensure that employees receive their rightful compensation. Employees should be aware of their rights and take action if they do not receive their final paycheck on time or if it is incorrect. By following these laws and regulations, both employers and employees can ensure a fair and just process for final paychecks.