Understanding PTO Payout Laws by State

PTO Payout Laws by State

What is PTO?

PTO is a type of leave that an employer provides to their employees as a benefit. It can be used for vacation, sick leave, personal days, and other reasons. PTO policies vary by employer, but typically employees earn a certain amount of PTO based on their length of service with the company.

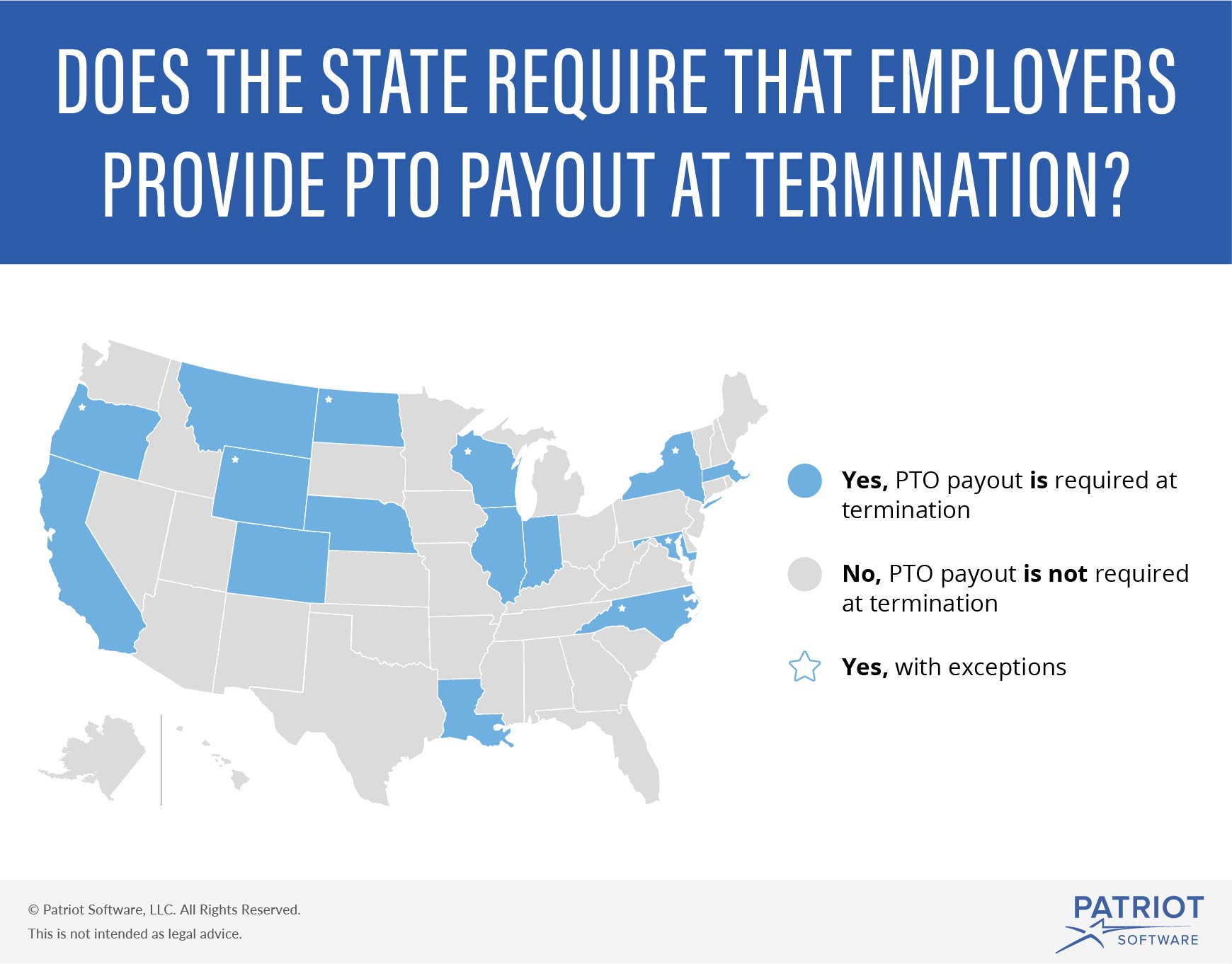

PTO Payout Laws by State

PTO payout laws vary by state, with some states requiring that employers pay out unused PTO when an employee leaves their job, and others allowing employers to choose whether or not to pay out unused PTO. Some states have specific requirements around PTO payout, such as the timing of the payout and the rate at which the PTO must be paid out.

States that Require PTO Payout

California, Montana, and Nebraska are three states that require employers to pay out unused PTO when an employee leaves their job. In California, employers must pay out unused PTO at the employee's final rate of pay, while in Montana and Nebraska, employers must pay out unused PTO at the employee's average hourly rate.

States that Allow Employers to Choose

Many states allow employers to choose whether or not to pay out unused PTO when an employee leaves their job. These states include Arizona, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

States with Specific Requirements

Some states have specific requirements around PTO payout. For example, in Illinois, employers must pay out unused PTO within the next scheduled payday after an employee leaves their job. In Massachusetts, employers must pay out unused PTO within 10 days of an employee leaving their job. In New York, employers must pay out unused PTO at the employee's final rate of pay if the employer's policy does not specify a different rate.

Pros and Cons of PTO Payout Laws

There are pros and cons to PTO payout laws. On the one hand, PTO payout laws ensure that employees are compensated for the time off that they have earned. This can be especially important for employees who have been with a company for a long time and have accumulated a significant amount of PTO. On the other hand, PTO payout laws can be costly for employers, especially in states where employers are required to pay out unused PTO. This can make it more difficult for employers to offer generous PTO policies in the first place.

FAQs

Q: What is the difference between PTO and vacation time?

A: PTO is a type of leave that can be used for vacation, sick leave, personal days, and other reasons. Vacation time specifically refers to time off work that is used for vacation or personal travel.

Q: Can an employer take away PTO that has already been earned?

A: In most cases, an employer cannot take away PTO that has already been earned by an employee. However, employers may be able to change their PTO policies going forward to limit the amount of PTO that employees can earn.

Q: How is PTO calculated?

A: PTO is typically calculated based on an employee's length of service with the company. For example, an employee may earn 10 days of PTO per year for their first five years with the company, and then 15 days of PTO per year for every year after that.

Q: Can an employee use PTO during their notice period?

A: Whether or not an employee can use PTO during their notice period will depend on their employer's policies. Some employers allow employees to use their remaining PTO during their notice period, while others require employees to work through their notice period without using PTO.