Vehicle Repossession Laws by State

What is Vehicle Repossession?

Vehicle repossession is the process in which a lender takes back a vehicle from a borrower who has failed to make their loan payments. When a borrower finances a vehicle, the lender holds a lien on the vehicle until the loan is paid off. If the borrower stops making payments, the lender has the legal right to repossess the vehicle.

How Does Vehicle Repossession Work?

When a borrower defaults on their loan, the lender will typically send a notice of default and demand for payment. If the borrower fails to make the payment, the lender can then send a notice of repossession. The lender can then hire a repossession company to take possession of the vehicle. In some states, the lender may be required to provide notice to the borrower before repossessing the vehicle.

What Happens After the Vehicle is Repossessed?

After the vehicle is repossessed, the lender will typically attempt to sell the vehicle to recoup their losses. The proceeds from the sale will be applied to the outstanding loan balance. If there is a surplus, the lender may be required to return it to the borrower. If there is a deficiency, the borrower may be responsible for paying the remaining balance.

State-Specific Vehicle Repossession Laws

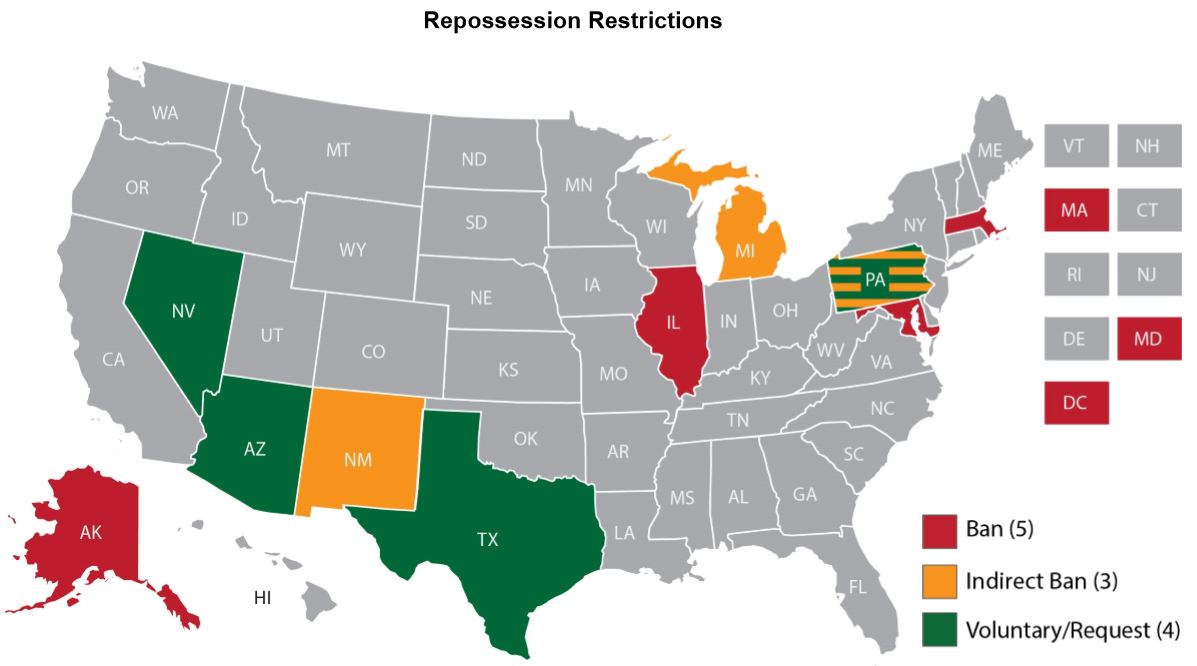

Each state has its own specific laws regarding vehicle repossession. Some states require the lender to provide notice to the borrower before repossessing the vehicle, while others do not. Some states require the lender to provide the borrower with the opportunity to cure the default before repossessing the vehicle. It is important for borrowers to understand the laws in their state to know their rights and to avoid any potential legal issues.

State-Specific Laws

| State | Notice Required? | Right to Cure? |

|---|---|---|

| California | Yes | Yes |

| Texas | Yes | No |

| Florida | No | Yes |

Advantages and Disadvantages

The advantage of vehicle repossession is that the lender can take back the vehicle from the non-paying borrower. The drawback of vehicle repossession is that the borrower can lose their vehicle and still be responsible for the remaining loan balance.

Conclution

Vehicle repossession is a serious legal matter that can have significant consequences for borrowers. It is important for borrowers to understand the laws in their state and to know their rights in order to avoid any potential legal issues. If you are facing vehicle repossession, it is important to seek legal advice to protect your rights.

FAQs

1. What is the difference between voluntary and involuntary repossession?

Voluntary repossession is when a borrower voluntarily surrenders their vehicle to the lender. Involuntary repossession is when a lender takes back a vehicle from a borrower who has defaulted on their loan.

2. How long does a lender have to wait before repossessing a vehicle?

The amount of time a lender must wait before repossessing a vehicle varies by state. Some states require the lender to provide notice to the borrower before repossessing the vehicle, while others do not.

3. Can a lender repossess a vehicle if the borrower is only one payment behind?

The lender may be able to repossess the vehicle if the borrower is only one payment behind, depending on the laws in the borrower's state and the terms of the loan agreement.

4. What happens if the lender sells the vehicle for less than the outstanding loan balance?

If the lender sells the vehicle for less than the outstanding loan balance, the borrower may be responsible for paying the remaining balance.