Understanding the Insurance Value Chain: Key Components and Interconnected Processes

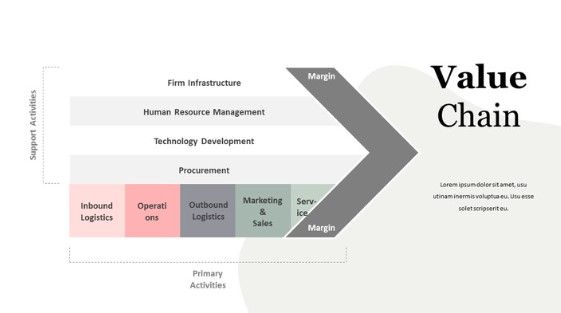

The insurance value chain is a series of activities that insurance companies perform to deliver insurance products and services to their customers. The value chain can be divided into five main stages:

- Product development: Insurance companies develop new products and services to meet the needs of their customers. This includes researching and understanding customer needs, designing new products, and testing and launching new products.

- Distribution: Insurance companies distribute their products and services to their customers through a variety of channels, including agents, brokers, and direct marketing.

- Underwriting: Insurance companies assess the risk of each customer and determine the appropriate premium. This includes collecting information about the customer's risk factors, such as their age, health, and driving history.

- Claims: Insurance companies process claims from customers who have experienced a loss. This includes investigating the claim, determining the amount of the loss, and paying the claim.

- Customer service: Insurance companies provide customer service to their customers to help them understand their policies and to resolve any problems they may have. This includes answering questions, resolving problems, and providing assistance with claims.

Each stage of the insurance value chain adds value to the product or service that is delivered to the customer. The insurance company's ability to effectively manage each stage of the value chain can have a significant impact on its profitability.

Here are some of the key challenges that insurance companies face in managing the value chain:

- Competition: The insurance industry is highly competitive, and insurance companies must constantly innovate to stay ahead of the competition.

- Regulation: The insurance industry is heavily regulated, and insurance companies must comply with a variety of regulations.

- Technology: Technology is changing the way insurance is delivered, and insurance companies must invest in new technologies to stay competitive.

- Customer expectations: Customer expectations are changing, and insurance companies must adapt their products and services to meet these expectations.

Understanding the Insurance Value Chain: Key Components and Interconnected Processes

The insurance value chain is complex and ever-changing. Insurance companies that can effectively manage the value chain will be well-positioned to succeed in the future.

The insurance industry operates through a complex network of interconnected activities, often referred to as the insurance value chain. This value chain encompasses various stages, from product development to claims management, that contribute to the delivery of insurance products and services. In this article, we will explore the key players and processes involved in the insurance value chain, shedding light on the intricate workings of the industry.

- Product Development:The insurance value chain begins with product development. Insurance companies analyze market needs, conduct research, and design insurance products that meet the demands of individuals, businesses, and organizations. This involves identifying risks, determining coverage options, and setting premium rates. Product development teams collaborate with underwriters, actuaries, and market researchers to create innovative and competitive insurance offerings.

- Marketing and Distribution:Once insurance products are developed, the focus shifts to marketing and distribution. Insurance companies employ various channels to reach potential customers, such as insurance agents, brokers, online platforms, and direct sales teams. Marketing efforts aim to create awareness, generate leads, and attract customers. Effective distribution strategies ensure that insurance products are accessible and tailored to the needs of different target markets.

- Underwriting and Risk Assessment:Underwriting is a critical function within the insurance value chain. Underwriters evaluate insurance applications, assess risks, and determine the terms and conditions of coverage. They analyze factors like policyholder information, risk exposure, and actuarial data to make informed decisions. Underwriters play a crucial role in managing risk and maintaining the financial stability of insurance companies.

- Premium Collection and Policy Issuance:Once an insurance policy is underwritten and approved, the premium collection process begins. Insurance companies collect premiums from policyholders based on the agreed-upon terms. Policy issuance involves providing the policy document to the insured, outlining the coverage details, terms, and conditions. This stage involves efficient administrative processes to ensure accurate record-keeping and compliance with regulatory requirements.

- Claims Management:Claims management is a pivotal aspect of the insurance value chain. When policyholders experience covered losses or events, they file insurance claims for compensation. Claims adjusters play a vital role in investigating, evaluating, and settling these claims. They assess damages, review policy coverage, negotiate settlements, and facilitate the payment of claims. Effective claims management is essential to maintaining customer satisfaction and trust.

- Reinsurance:Reinsurance is a process wherein insurance companies transfer a portion of their risk to other insurers known as reinsurers. Reinsurers help insurance companies mitigate the financial impact of large and catastrophic losses. Reinsurance allows insurers to spread their risk across multiple parties, ensuring their ability to fulfill obligations to policyholders in the event of significant claims.

- Risk Management and Loss Control:Risk management is a fundamental part of the insurance value chain. Insurance companies employ risk managers who identify, assess, and mitigate potential risks. They develop strategies to minimize loss exposures, implement safety protocols, and evaluate the effectiveness of risk control measures. Effective risk management practices enhance the financial stability and profitability of insurance companies.

- Customer Service and Support:Throughout the insurance value chain, customer service and support are paramount. Insurance companies strive to provide exceptional customer experiences, including prompt and efficient communication, policy inquiries, claim support, and policyholder assistance. Robust customer service ensures customer satisfaction, retention, and loyalty.